special tax notice irs

To apply for a waiver you must. State Income Taxes.

Tax Tip Notice From Irs Something Is Wrong With 2021 Tax Return Tas

Notice of Intent to distribute benefits.

. On October 30 2020 the Department of Treasury Treasury Department and the IRS published a notice of proposed rulemaking NPRM REG-119890-18 in the Federal Register. This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover.

The article notes that the IRS last updated the model notices in Notice 2014-74 to incorporate changes in the law since 2009. This notice must be given to plan participants beneficiaries and alternate payees when the employer requests a waiver of the minimum funding requirement from the IRS. IRA or an employer plan.

This notice is intended to help you decide whether to do such a rollover. However the employee may waive the 30-day period. The 500 minimum is less than the 1000 minimum for IRS estimated taxes.

If you are a Virginia resident VRS withholds 4 percent of the taxable amount and forwards it to the Virginia Department of Taxation as state income tax withholding to be. Irs model special tax notice regarding plan payments. The employer must give the notice between 30-180 days before an employee receives a distribution.

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. To apply for a waiver you must. This notice describes the rollover rules that apply to payments from the Plan that are not from.

For more information about the Employee Retention Credit ERC IRS Notice 2021-20 visit the Internal Revenue Service IRS Department of the Treasury official IRSgov tax website. Castleton emphasizes that the model notices as. Before age 59½ unless an exception applies.

To properly print this document hover your mouse over the document PREVIEW area. For example small cars under 6000 lbs Luxury autos are capped at 18000 of depreciation in the first year 10000 if bonus deprecation is not taken due to luxury auto. After-tax contributions maintained in a separate account a special rule may apply to determine whether the after-tax contributions are included in the payment.

Limited circumstances you may be able to use special tax rules that could reduce the tax you owe. The notice is provided to each affected participant or beneficiary and specifies the amount of the participants benefit as of the. For a payment to be treated as a lump sum distribution you must have been a participant in the plan for at least five years before the year in which you received the distribution.

Use the print buttons in the Preview. In addition special rules apply. Irs model special tax notice regarding plan payments.

Tax Guide for Aliens and IRS Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. IRS Form 402f - Special Tax Notice. For more information see also IRS Publication 519 US.

However if you receive the payment before age 59½ you may have to pay an additional. It may also be different from the minimum amount to make estimated tax payments to another state. However if you do a rollover you will not have to pay tax until you receive payments later and the 10 additional income tax will not apply if.

Other special rules If a. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on your.

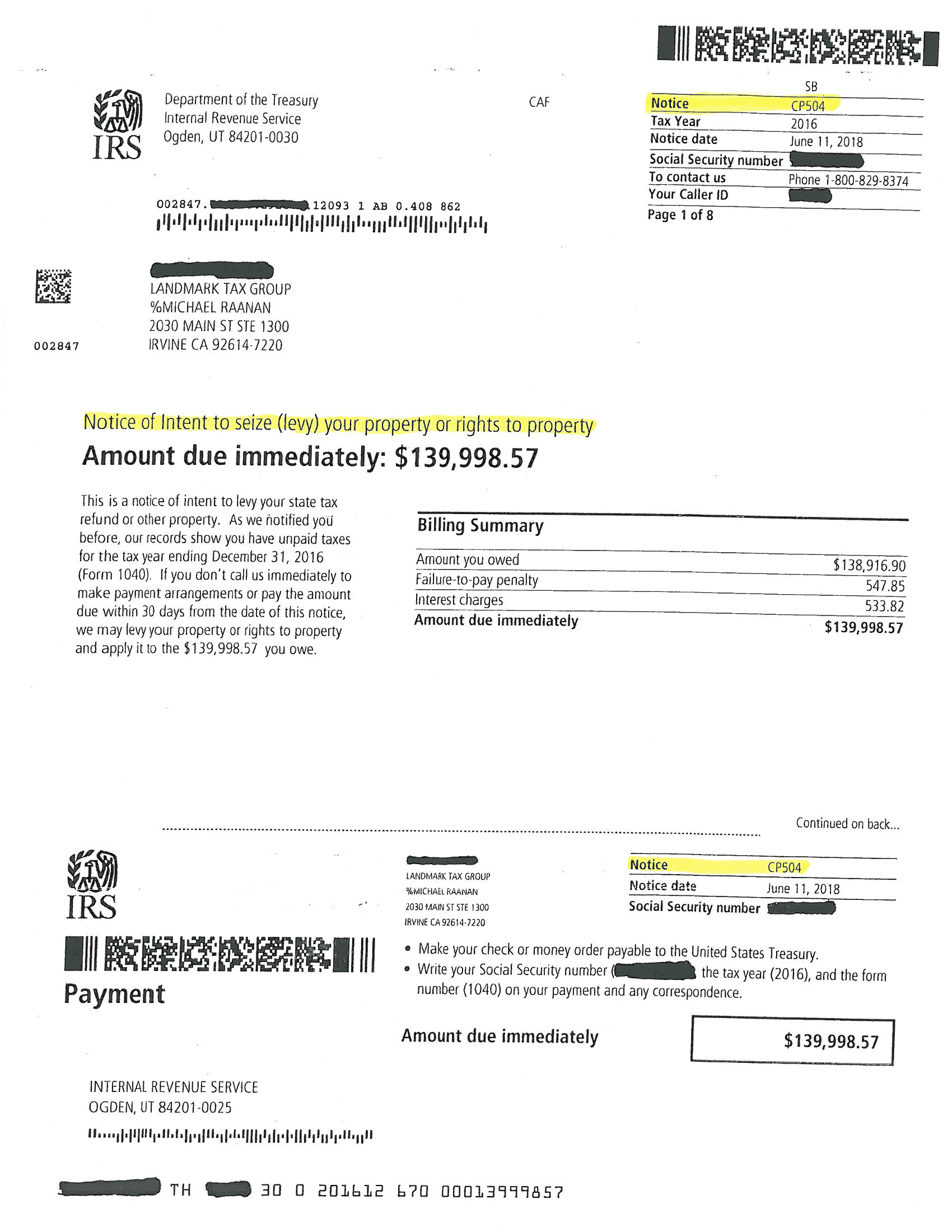

Irs Cp504 Tax Notice What Is It Landmark Tax Group

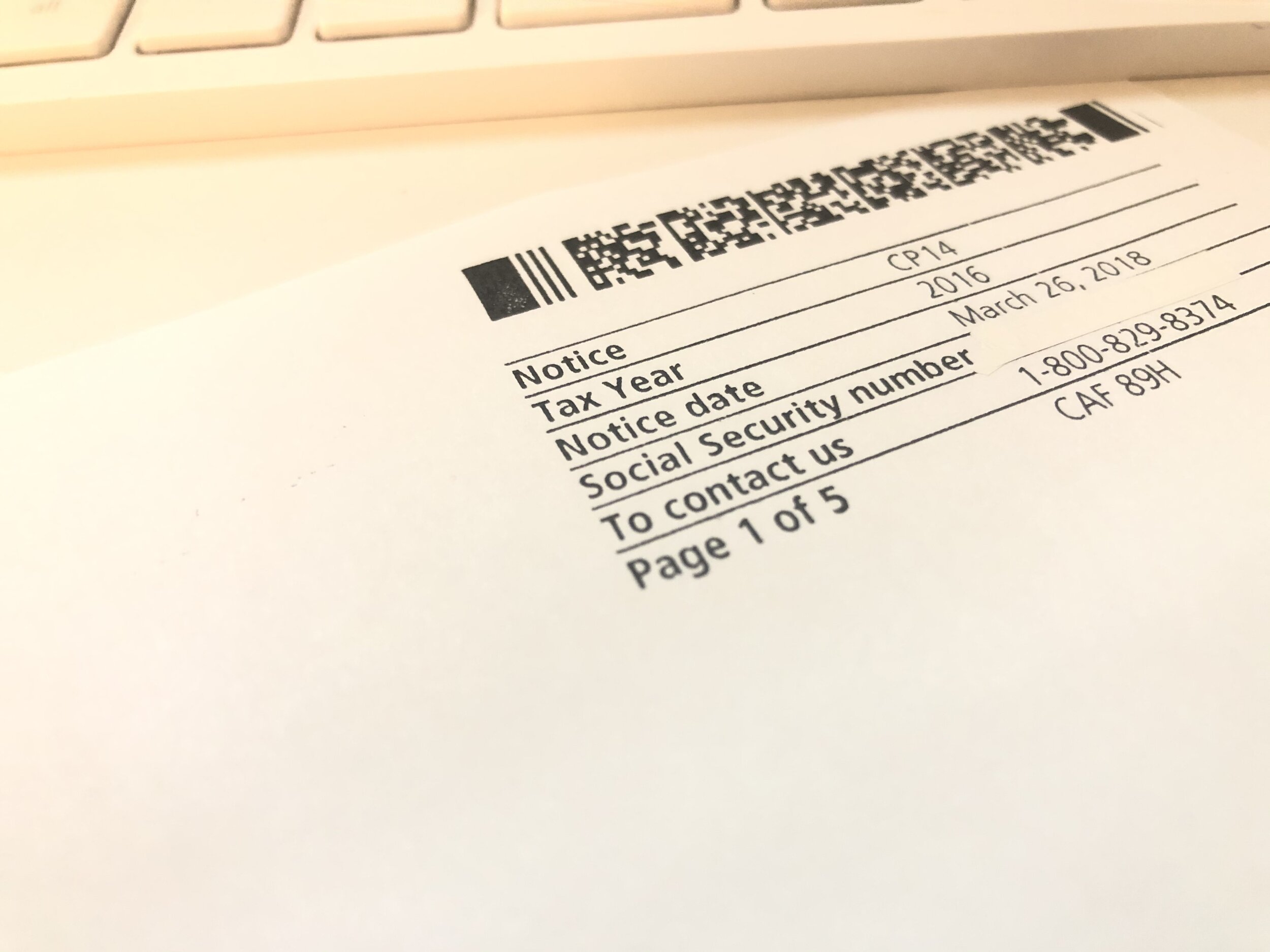

Irs Audit Letter Cp14 Sample 1

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

What Is The Number On Your Irs Notice Milda Goeriz Attorney At Law

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

List Of Authentic Irs Cp Notices Tax Defense Group

Don T Fear The Tax Man Handling Irs Letters Notices Turbotax Tax Tips Videos

Cmk Financial Services Llc What To Do When You Get A Notice From The Irs

Here S A Guide To File Your 2021 Tax Returns Wfaa Com

Responding To Irs Letters Tax Notices Alizio Law Pllc

About Form 2848 Power Of Attorney And Declaration Of Representative Internal Revenue Service

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

What To Do When You Receive A Cp2000 Notice From The Irs For Your Cryptocurrency Taxes Cointracker

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Audit Letter 566 Cg Sample 3

Irs Notices And Letters Where S My Refund Tax News Information